Describe the Benefits of Using Financial Statements in Financial Planning

As a business owner. 4 Develop and implement.

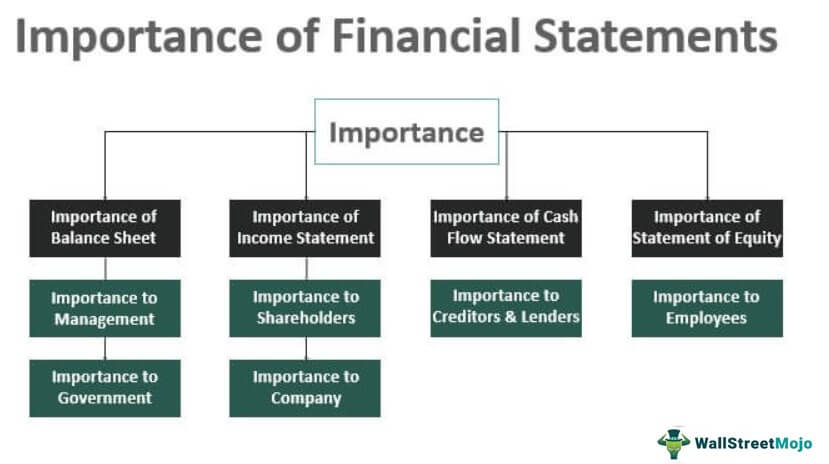

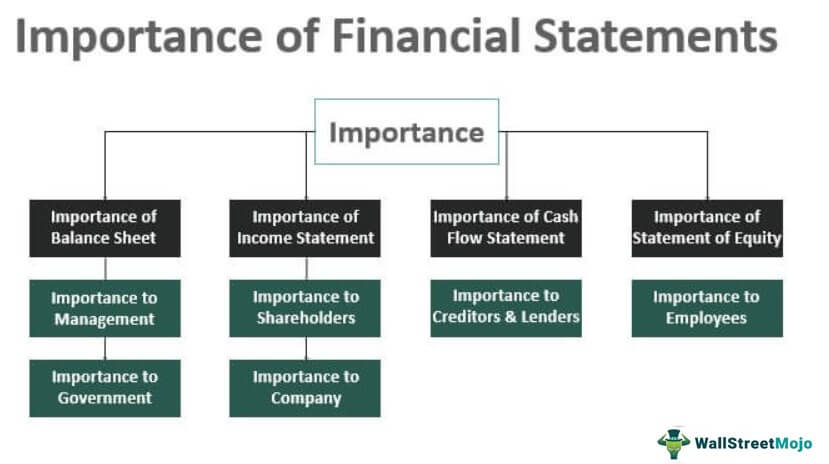

Importance Of Financial Statements Top 10 Reasons

Planning helps in guaranteeing a harmony between outgoing and incoming of assets with the goal that stability is kept up.

. It gives a clear picture of the financial affairs of the company its performance which can be. Ad Roadmap Your Financial Goals Be Prepared For Whatever Life Throws At You. Financial statements of the company are the most important information about the company.

Finance Technology to Improve Analytics for Better Insights into Profit Loss Impacts. In summary financial analysis and reporting can help businesses of all sizes to build trusted relationships with investors shareholders employees and even customers. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Ad Learn More About American Funds Objective-Based Approach to Investing. 2 Develop the financial plans and strategies needed to achieve those goals. Ad Financial Strategies from EY Can Create a Path Forward and Benefit Your Whole Enterprise.

Financial planning helps you understand your goals better in terms of why you need to achieve these goals and how they impact other aspects of your life and finances. When setting team goals leverage financial statements to provide context for why specific benchmarks were targeted and the thought process behind your plans for reaching. Your financial statements can also be used as a powerful management tool to affect positive change within your organizationwhen used the right way.

Dont Hesitate to Take The Next Step In Your Wealth Journey. Using Financial Statements to Detect Patterns and Trends Looking at past financial statements can be extremely helpful in identifying business trends for the year. The general purpose of the financial statements is to provide information about the results of operations financial position and cash flows of an organization.

Ad Roadmap Your Financial Goals Be Prepared For Whatever Life Throws At You. She has decided to pay a visit to a financial advisor for help. 1 Define your financial goals.

Benefits of using financial statements in financial planning Utilize and explain from BUSINESS FIN420 at Universiti Teknologi Mara. Short of having a crystal ball pro forma financial statements can help you predict things like net income and gross profit in the future. The use of information in planning Chapter 1 Which life stage typically is best characterized by the following financial circumstances.

The year-to-date data is often. Write a 700- to 1050-word paper that. Benefits of using financial statements in financial planning assignment.

Anyone working in the financial planning and analysis FPA department should be very familiar with the three financial statements in. Pro forma financial statements can be used to provide forecasts of your small businesss full-year results utilizing its year-to-date information. Using these financial statements you can.

How to Use the Three Financial Statements in FPA. The importance is as follows- Guarantees sufficient funds. Decrease in expenses and spending needs more leisure.

Youll have money This one seems kind of obvious but when you plan with a purpose and manage your money effectively you will. 3 Implement your financial plans and strategies. Dont Hesitate to Take The Next Step In Your Wealth Journey.

6 Advantages of Personal Financial Planning 1.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition Types Examples

Non Profit Financial Statement Template Awesome Yearly Business Plan Template In E Statemen Statement Template Personal Financial Statement Financial Statement

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Belum ada Komentar untuk "Describe the Benefits of Using Financial Statements in Financial Planning"

Posting Komentar